Lemonade’s Rise

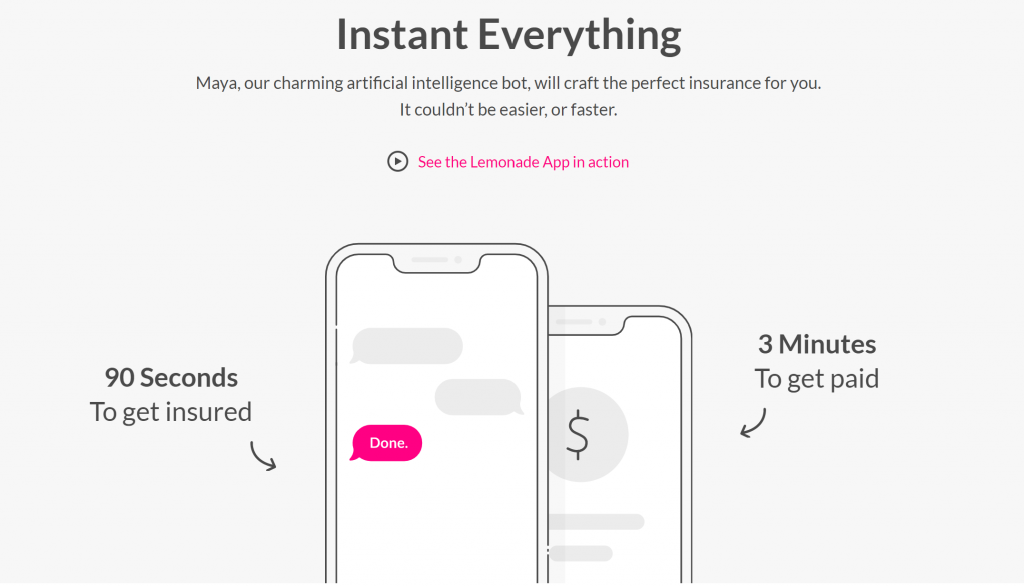

What Lemonade saw was that there plenty of companies using traditional means to service the insurance industry. They use people to give quotes and to process claims. Which led to higher premiums and longer wait times for quotes and payouts. But Lemonade is building an Artificial Intelligence capable of doing those activities. They are offering lower rates and instant quotes.

And they done it in an intelligent way. Lemonade started providing small insurance claims (apartments and small personal belongings like bicycles) for people in cities. In fact, they started so small that they flew under their competitor’s radar for years. Just like on the diagram on the previous page, their initial product performed the lowest market performance requirements. However, the niche they chose allowed them to refine and fine-tune various parts of their algorithm.

As time marches forward, their product continues to fulfill more and more of the market needs – just as I said it would in the second bullet point of my email. Originally, they focused on renters and small personal items for city residents. As of the time of this writing, it now provides homeowners, renters, and pet insurance. They offer claims in the cities, suburbs, and rural areas. And they do it at lower rates with quicker turn around times.

So if Lemonade is now eating into the territory of the traditional insurance providers, what is their next move? My prediction kicks into high gear on the next page.