It’s official now. The tax bill has passed through the American Congress and has been signed into law by the President promising a tax break for one and all. And, I know this to be true because we all received our president’s version of an official statement.

We are delivering HISTORIC TAX RELIEF for the American people!#TaxCutsandJobsAct pic.twitter.com/lLgATrCh5o

— Donald J. Trump (@realDonaldTrump) December 20, 2017

Great, now what are we going to do with all of our cash?

But the question remains, how are companies planning to use it? The early analysis suggests that many aren’t sure, which was shown through this exchange during the Wall Street Journal’s CEO Council in November 2017:

1. Tax-overhaul backers say corporate rate cut will encourage investment by businesses

2. During #wsjceocouncil interview with Gary Cohn, WSJ asks CEOs to raise hands if they'll boost investment if rates cut

3. Few CEOS raise hands

4. Cohn asks: "Why aren't the other hands up?" pic.twitter.com/5PI60NlW0A— Tim Hanrahan (@TimJHanrahan) November 14, 2017

And then, there was this follow up reporting on Bloomberg:

Major companies including Cisco Systems Inc., Pfizer Inc. and Coca-Cola Co. say they’ll turn over most gains from proposed corporate tax cuts to their shareholders, undercutting President Donald Trump’s promise that his plan will create jobs and boost wages for the middle class.

Trump’s Tax Promises Undercut by CEO Plans to Help Investors

This approach, of buying back company stock or returning more money in the form of dividends is, at least according to the author’s of the Harvard Business Review article Strategy in the Age of Superabundant Capital, the economic equivalent of “throwing up your hands and asking shareholders to find good investments on their own.”

Are there any other options?

Investing is the right idea. But instead of investing in shareholders, invest in your company’s future. Invest in innovative ideas that expand your current “crown jewels,” to borrow a term from author Geoffrey Moore, and use that expertise to springboard new ideas, push into new sectors, or reach out to new customer groups.

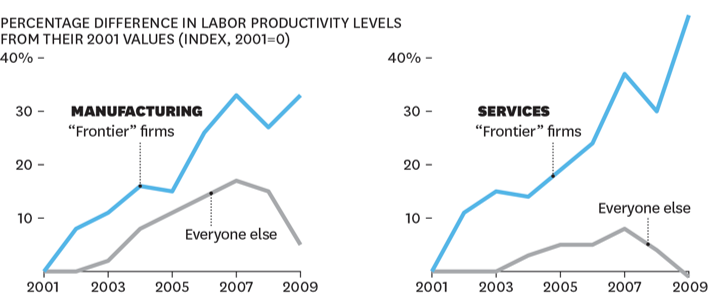

When performed strategically and methodically, investing in innovation has proven to be a key differentiator between productivity levels in the “frontier” firms and everyone else. The graphic below is from research performed in 2015 by the Organisation for Economic Co-operation and Development (

How do you effectively invest the tax break in innovation?

Perhaps one of the companies that has proven the best at adopting new approaches to business is Disney. Their CEO, Bob Iger, is famously on record as saying “[t]he riskiest thing we can do is just maintain the status quo.” In the book Good to Great, author Jim Collins talks about a company’s need to preserve their core values while adapting the products and services they provide to meet the changing business landscape. The image below is pulled straight from that text and examines how Disney has continued to evolve the way they provide their customers with family entertainment.

What is Disney’s secret?

Disney’s secret is rather simple – it knows what its mission is. It has its identified core values and/or core beliefs, and it continually looks for new ways to bring those values to its current and future generation of customers.

Think about it. Disney is known for a wide range of products. They have movies. They have theme parks. They are the proud owners of ABC, ESPN, Pixar, Star Wars, and Marvel Comics. And yet, none of those revenue streams overlap. They all support each other. ESPN and ABC share sports broadcasts. Go to their theme parks, and you’ll see Avenger-themed rides. Each of these product lines provides Disney with a new avenue to leverage their crown jewels and engage a different market segment. And they all work hand in hand to delivery family entertainment.

What will it take for you to emulate Disney?

While it will most certainly take many companies time to emulate the profits that Disney currently enjoys, there are three steps that you can take today to ensure that you are pushing your own current limits.

The riskiest thing we can do is just maintain the status quo. – Bob Iger, Chief Executive Officer, The Walt Disney Company

Step 1: Know who you are

You can’t begin to push your limits without first knowing who you are. That means knowing two things. One, you need a defined mission. That mission can be broad. Take our mission, at Ever Evolving our mission is to help the world and all of its inhabitants evolve into their best selves. While that gives us plenty of room to work with, it also makes it absolutely clear that every effort we undertake has to be designed to drive our partners and customers forward.

Two, you need to know what you are the very best in the world at. Again, using Ever Evolving as an example, we are the very best at taking ideas from conception to reality. We have designed frameworks to simplify that process. We have built tools and templates to do it faster and with greater precision.

Step 2: Know where you are going

Knowing where you are going comes down to two things, identifying strategic priorities based on where your industry is going, and building a tactical plan to achieve those priorities.

Now that tactical plan will likely have one or more identified gaps. And that’s fine. Ideally, those gaps will be what drives the innovations that your company invests in.

Step 3: Set yourself up for success

Setting yourself up for success comes down to leveraging what you’ve done well in the past. Like Disney promoting Marvel in their theme park, you want to use any past successes to promote future efforts.

I had the good fortune of supporting the Marine Corps for more than a few years. They were fond of a saying that I’ve come to adapt myself. The quote is from John Steinbeck, the Nobel-prize winning author of “Of Mice and Men,” and it says “if you find yourself in a fair fight, your tactics suck.” Do whatever you can to legally stack the deck in your favor. There are rules, and you have to follow the rules. But give ever opportunity every chance for success.

Invest for success

To guarantee your future, you need to invest in it. The tax break that has just worked its way through Congress can provide your organization with some extra capital to do just that. The question now is, will you invest wisely – in innovative efforts that can drive your company for years or decades to come. Or will you [again] throw your hands up and invest it in another round of stock buyback?