Bon Ton is the latest victim in the retail apocalypse, closing 47 stores while filing for Chapter 11. This is the latest in a string of high profile retail stores that have gone bankrupt. But the question remains, is this the fate of all retail stores? Or can they still compete in an Amazon-led world?

Evolution of Retail Stores

To examine the rise of the traditional retail stores, we are going to look at one specific store. THE store of the majority of the 20th century. Sears.

Sears began selling their products through catalogs to rural Americans. Then, in the 1920’s, sensing a movement of Americans into the suburbs thanks in part to the automobile, Sears began opening department stores. In the 1930’s and 1940’s, Sears continued expanding their reach. Opening new stores in new towns.

Fresh off that success, and running out of new places to build, Sears spent the 1950’s and 1960’s finding, buying or building brands to fill its department stores. Sears had everything that a modern American could want in 1969!

But winds changed in the 1970’s and 1980’s. Americans and their spending cash became interested in specialty stores and discount retailers. Which led to Sears losing $3.9 billion in 1992. By 2005, they were sold to Eddie Lampert.

What Went Wrong?

Sears, as is the case with many companies across every industry, Sears had two fatal flaws. One, they focused on what their customers were telling them, not where the market was going. Their customers told them that they were doing the right thing by continuing to rush to Sears for the latest Washer/Dryers and latest Craftsmen tools. But they failed to see that the market was changing and that they were being undercut. As Clayton Christensen said in The Innovator’s Dilemma, “…good management was the most powerful reason they failed to stay atop their industries.”

And when they started to fall behind, they looked to the past for a way out. They fell victim to the “Success Syndrome.” They never took these new competitors seriously, until it was too late. One former Sears executive boasted that “Sears doesn’t have competition save ourselves. Sears is number one, number two, three, and four. Take our sales and divide them by four and we’re still bigger than the next guy.”

And by only looking at the feedback from their customers without keeping an eye on their competitors, they build a top-heavy business that was too sluggish to move. It was said that in the 1990’s and early 2000’s, Sears management had a rulebook that was over 29,000 pages.

It is not the strongest of the species that survive, nor the most intelligent, but the one that is most responsive to change. – Charles Darwin

Challenges

While not every retailer is beginning from the same position that Sears did, they face many of the same challenges. For too long they were too slow addressing the challenges of the online market. And now they face a mature competitor, that has some advantages that their customers enjoy.

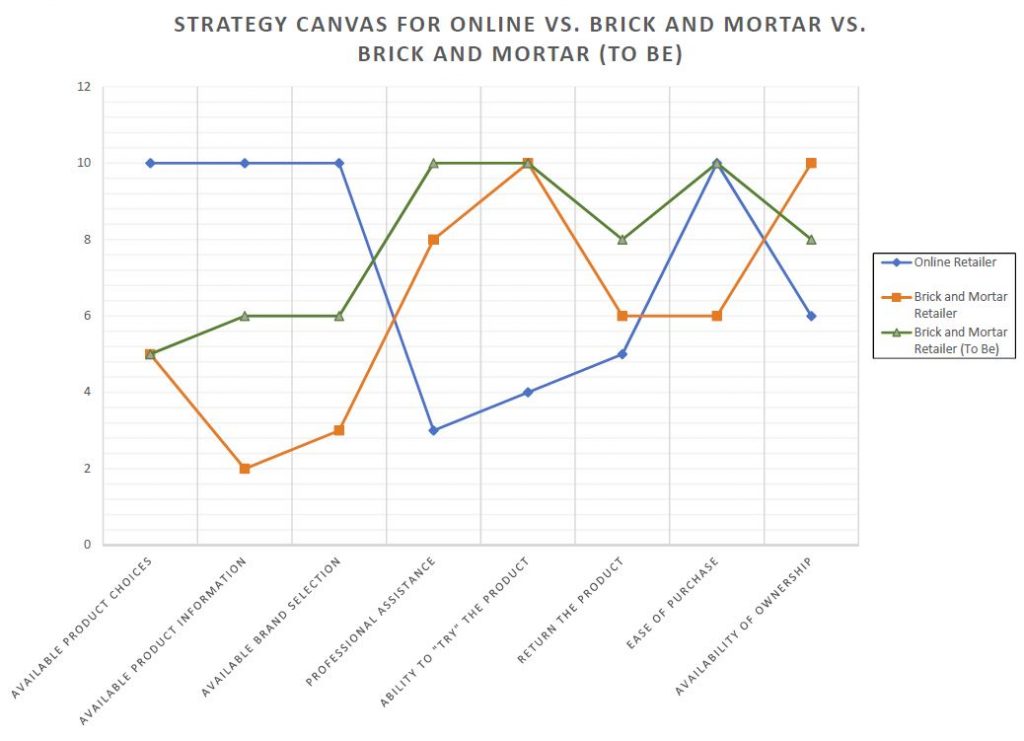

The figure below is my take on the strategy canvas concept made famous by W. Chan Kim and Renee Mauborgne in Blue Ocean Strategy. The strategy canvas shows how Brick and Mortar stores rate against online shopping across a variety of categories listed at the bottom. For the purposes of the canvas, the higher the score the better.

There are three lines in the image above. The blue line with diamond dots ranks where online shoppers rate for each category. The orange line with square dots ranks where brick and mortar stores rate. And the green line with triangle dots ranks where the to-be brick and mortar stores rate. That’s the line we will be discussing in the “Way Ahead” section below.

Based on the eight categories, online retailers have a decisive advantage across four categories:

- Available Product Choices – no store can carry all of the products that are listed on the internet

- Available Product Information – the internet provides more information and reviews about a product than is available in store

- Available Brand Selection – again, no store can carry as many brands as the internet

- Ease of Purchase – the fact that you can purchase something without leaving the house gives online shoppers a competitive advantage when it comes to ease of purchase

Advantages

Brick and mortar stores do have advantages of their own. Of the eight categories identified in the canvas above, they rate higher in the following:

- Professional Assistance – websites are trying to close the gap with their chat windows; however, they still have work to do

- Ability to “Try” a Product – you can’t “try before you buy” with an online store

- Ability to Return a Product – Online stores like Zappos are beginning to close the gap, but in instances where return shipping is not provided, returns can be dicey for online stores

- Availability of Ownership – Online retailers like Amazon are beginning to close this gap with free 2-day delivery, but if you need something immediately, you still have to go to the store to buy it

Way Ahead

Since both sides have clear advantages, the way ahead is to emphasize your strengths, while mitigating your weaknesses. When looking at the strengths and weaknesses of each, a few things become clear.

- It is very difficult for brick and mortar stores to compete on cheap, standardized products that are not needed immediately.

- But the higher the price tag and the more customization required, the more a customer will want to try a product before they purchase.

With that in mind, I have a few recommendations for the brick and mortar stores to better compete. These recommendations will provide a better shopping experience, and create that third green “to-be” line on the strategy canvas above.

Recommendation #1, brick and mortar stores should focus on higher quality, higher priced items. Leave the discount shopping to those people who prefer to buy from the web. The margins are too low on these products anyway, they aren’t worth your employee’s time to stock the shelves.

Recommendation #2, look at ways to bridge the experience between your in-store and online stores. Some companies have already started looking at this, with articles in Forbes and Harvard Business Review describing some of their troubles and successes.

Recommendation #3 piggy-backs on that idea, with looking at new ways to provide your shoppers with more information while they are in store. Again, some companies are already experimenting with these techniques, including Walmart with their Store Assistant and Macy’s with their On Call app.

Recommendation #4, find ways to make checkout faster. Amazon is famously tackling this, albeit still with some kinks to work out, with their Amazon Go Fast Check.

Recommendation #5, I would never let my store run out of an item. If my store got down to the last item of a specific size, I would not allow that item out of the store. Instead, I would offer to ship the item to the user for free and offer a discount on their next purchase. I understand that that is an inconvenience to the shopper. Again, I’m selling high quality/highly customizable products, which you can’t sell any of if they aren’t available to try first.

Conclusion

The retail experience as we know it is not dead. What we have been witnessing the past decade has been a thinning of the herd for sure, but with definitive competitive advantages on its side, brick and mortar retail stores will remain strong for the foreseeable future.